In the realm of business, the terms “leadership” and “management” are often used interchangeably, but they represent distinct approaches that play crucial roles in the success of an organization. While both are essential, understanding the differences between leadership and management can unlock new perspectives on how to effectively guide teams, drive innovation, and achieve organizational goals. In this article, we explore the nuanced differences between leadership and management and delve into the unique contributions each makes to the dynamic business landscape.

Leadership: Guiding with Vision and Inspiration

At its core, leadership centers around inspiring and influencing individuals to align with a shared vision. Leaders are visionary trailblazers who empower their teams by setting a compelling direction, fostering a sense of purpose, and motivating employees to transcend their limits. A true leader operates on the principles of authenticity and integrity, nurturing an environment where trust and collaboration flourish. Effective leaders are change agents who embrace ambiguity, take calculated risks, and adapt to dynamic challenges. They stimulate innovation, encourage creativity, and encourage the growth of their team members.

Management: Organizing and Executing Efficiently

Management, on the other hand, is the art of planning, organizing, and executing tasks to achieve established goals and objectives. Managers are responsible for optimizing processes, allocating resources, and ensuring tasks are completed efficiently and effectively. A skilled manager excels in decision-making, delegation, and problem-solving, ensuring the day-to-day operations of the organization run smoothly. They prioritize tasks, maintain schedules, and enforce accountability to maintain the overall structure and functionality of the business.

Leadership and Management: A Harmonious Symbiosis

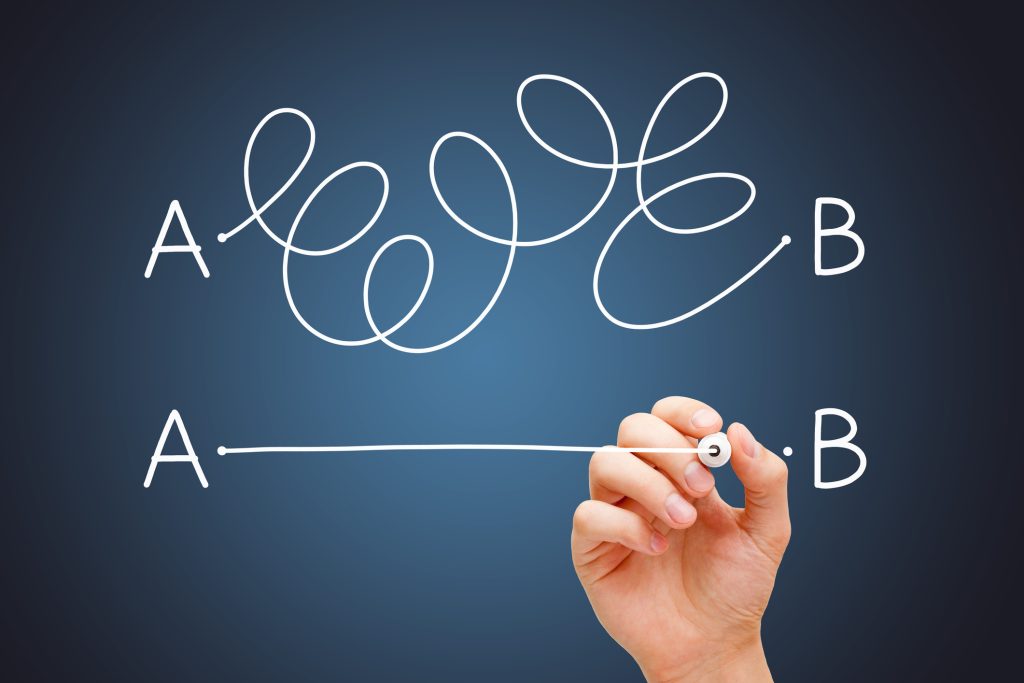

While leadership and management are distinct concepts, they are not mutually exclusive. The most successful organizations strike a balance between the two, recognizing that effective leadership complements efficient management. Leaders provide the visionary direction, while managers execute that vision methodically. The symbiotic relationship between leadership and management creates a harmonious environment that fosters growth, innovation, and operational excellence.

Cultivating Leadership and Management Skills

- Leadership Skills: To become an effective leader, hone skills in emotional intelligence, communication, empathy, and the ability to inspire and motivate others. Embrace a growth mindset, continuously learn, and model the behavior you expect from your team.

- Management Skills: Developing management skills involves mastering organizational abilities, decision-making, time management, and efficient resource allocation. Effective managers communicate clearly, set realistic expectations, and empower team members to perform at their best.

In the dynamic world of business, leadership and management are two sides of the same coin. Both are essential for achieving organizational success, yet they offer distinct approaches to guiding teams and achieving goals. Effective leaders inspire with vision and purpose, while skilled managers ensure efficiency and execution. Striking a harmonious balance between leadership and management fosters an environment of innovation, collaboration, and growth, propelling businesses toward sustained excellence in today’s competitive landscape.